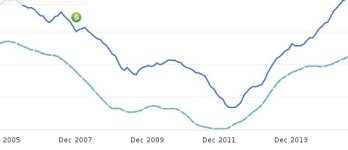

Hold off on buying unless you want to be underwater for the next 20-30 years as interest rates go back up to normal levels.

People, don't be fools. NOTHING has changed since 2007 except debt is now at even higher levels. Read the writing on the wall. Hold onto your savings, there will be great buying opportunities during and after the coming crash.

This bubble is much worse than previous bubbles. The bigger the bubble, the bigger the fall. There is no way to stop the economy from slowing further, the cost of living world wide is much too high. This isn't just a USA problem.

The coming financial melt down will be epic. All the stuff the government was afraid of happening in 2007 and then some. Expect business to slow further. Expect layoffs. Expect a depression, the likes of which hasn't been seen since the last great depression. A depression is the only thing that can reset the economy and cost of living.

Only when people/investors/banks take their bubble losses, and housing and food costs go back to normal percentage ratios of incomes. Can the economy finally rebound and boom/grow. We are in the death throws of this current investor driven economy.

I say investor driven, because last thirty years the economy has been kept alive by housing prices going up up and up. People taking cash out, refi, spending. Then when that party was over, and it all was about to come crashing down. The crash was temporarily stopped, and economy kept alive last few years by huge government bailouts, fed pouring in trillions into markets. Yes TRILLIONS! The amount of debt we have accumulated as a society is unprecedented. (don't be too surprised if it leads us to more wars)

Its simple math. Consumers are strapped. The higher mortgages, taxes and rents and food prices go, the quicker the economy will choke itself out. There is NO STOPPING IT. It is impossible for the economy to rebound or boom with consumers at this level of debt. How can it with current housing and food costs? Impossible.

Bay area right now is booming due to being flush with investor capital, started by the fed pouring trillions into the markets, lowering interest rates to zero, causing the stock markets to rebound and boom. Giving bay area tech and biotech companies stupid investor money to play with, and pay incomes with. This also ran up housing and stock prices again, giving many money to play with and keeping this investor economy limping along. However that party is almost over. There is nothing to keep these stock and housing prices growing.

Stock market investors expect growth and profits otherwise they will pull their money out. Tech and biotech companies are not showing growth or strong profits. In fact many of them are losing millions each quarter. How long do you think markets can stay up, without the fed pouring in trillions? Expect a downturn and then a market crash. This time without a large government bailout, as the last bailout will be viewed as a failure.

The unicorn companies will fail and fall first. Stocks will fall, markets will collapse. Layoffs will ensue. There will be some hard times. Prices will collapse. Banks will fail. Interest rates will go up. But in the end cost of living will go back to normal percentages and we will start all over again from the bottom to build the next bubble economy. Nothing to be alarmed over, its just the normal 100 year cycle of things.

Now for pure comedy read the below, negative interest rates! Apparently Fed stupidity has no bounds. lol

Fed officials seem ready to deploy negative rates in next crisis.

http://www.marketwatch.com/story/fe...ploy-negative-rates-in-next-crisis-2015-10-10

Can someone here even explain how this would work?

) in 2007. Friends bought a house in that neighborhood in July 2011 for low $500k. Zillow (unreliable , I know) now has their house around $900k. I just looked and there are three similar houses for sale (5/3.5 3,100 - 3,600SF) $879k, $900k and $918k so zillow's probably in the ballpark.

) in 2007. Friends bought a house in that neighborhood in July 2011 for low $500k. Zillow (unreliable , I know) now has their house around $900k. I just looked and there are three similar houses for sale (5/3.5 3,100 - 3,600SF) $879k, $900k and $918k so zillow's probably in the ballpark.

JFC.

JFC.